A couple months back, Trulia came out with a shocking study that proclaimed Austin is the “most overvalued” housing market in the country. Now, Fitch, the big rating agency, has come out with their own report saying the same thing.

I strongly considered writing a blog post when the Trulia article came out, but life got in the way. However, now that another major group has come out with the same opinion, I have no choice but to dispel the myth that Austin is in a housing bubble.

And for full disclosure, I’d love it if Fitch and Trulia were right about this. Because when it comes to the Austin housing market, I’m on the outside looking in. I’ve been renting a house for the last 4 years, hoping to buy a home in the next couple years, but watching helplessly from the sidelines as the region’s housing prices skyrocket. So, I have every reason to want to believe Fitch and Trulia…but these guys are just plain wrong about the Austin housing market. Here are three reasons that show just how wrong they are.

Reason #1) The Economy

All you have to do is drive around Austin for an hour or two (okay maybe three or four hours because the traffic is so bad) and you’ll see TONS of construction, much of which is new housing. New apartment complexes. New single-family subdivisions. New mixed-use residential/commercial buildings. New high-rise residential towers downtown. There is new housing being built everywhere in the region, from the thousands of new apartments in downtown Austin to the thousands of new large-lot homes in the far reaches of the metro area.

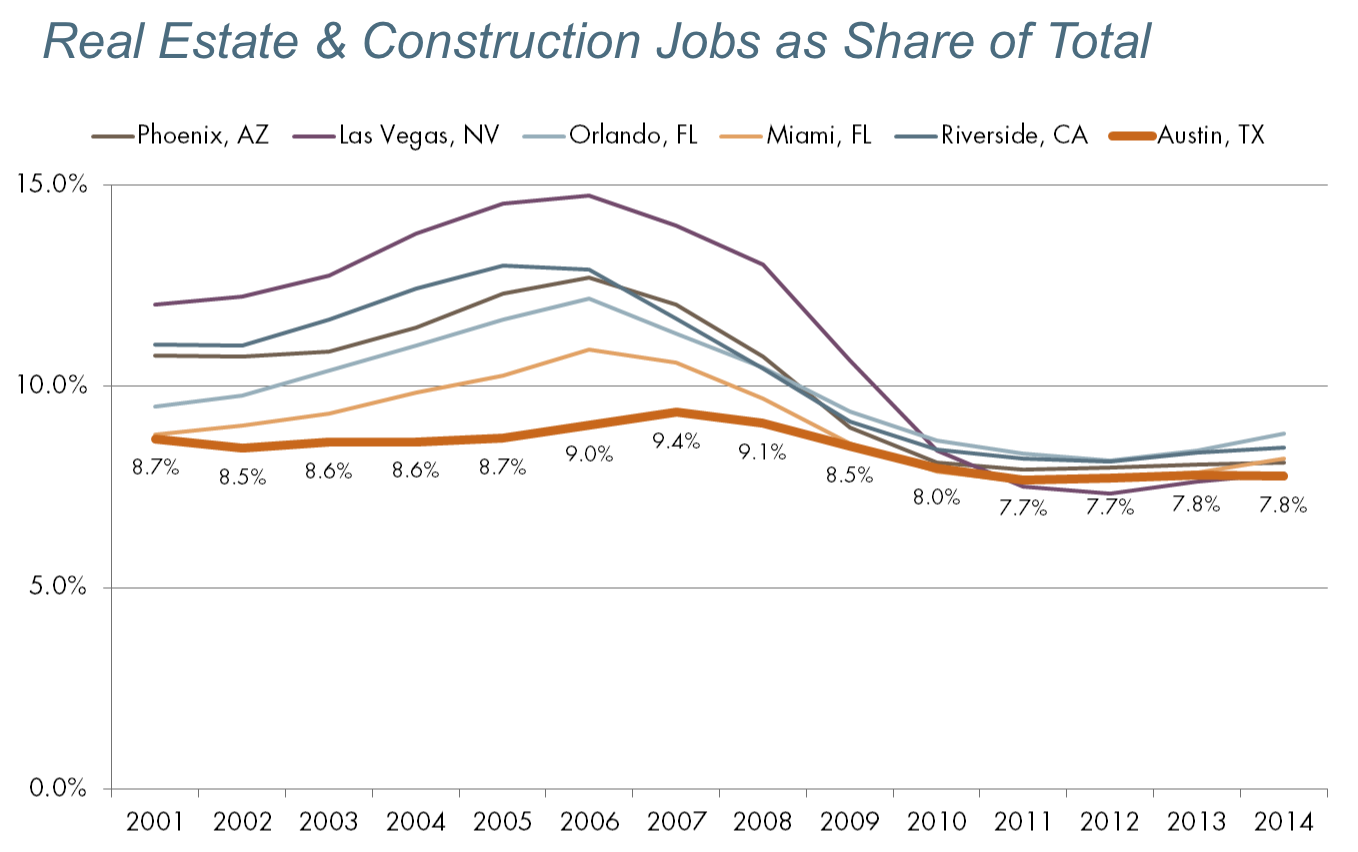

Naturally, people tend to get the impression that the regional economy is booming because of the real estate and construction industry. But this notion could not be farther from the truth. Enter graph #1…

Percentage of Jobs in the Real Estate & Construction Industry

My first instinct when I read the Trulia article was to compare Austin’s economy today with some of the markets that really did go through a housing bubble back in the mid-2000s (places like Phoenix, Las Vegas, and Riverside, CA). So I calculated the percentage of Austin’s jobs in the real estate and construction sectors, out of the region’s total employment, from 2001 to 2014. And then I did this same calculation for five bubble markets (Phoenix, Las Vegas, Riverside, Orlando, and Miami).

This data clearly shows that Austin’s real estate and construction industry is not driving the regional economy. It’s actually the other way around. The region’s nation-leading economic vitality is leading to a red-hot local real estate market.

Reason #2) Supply & Demand

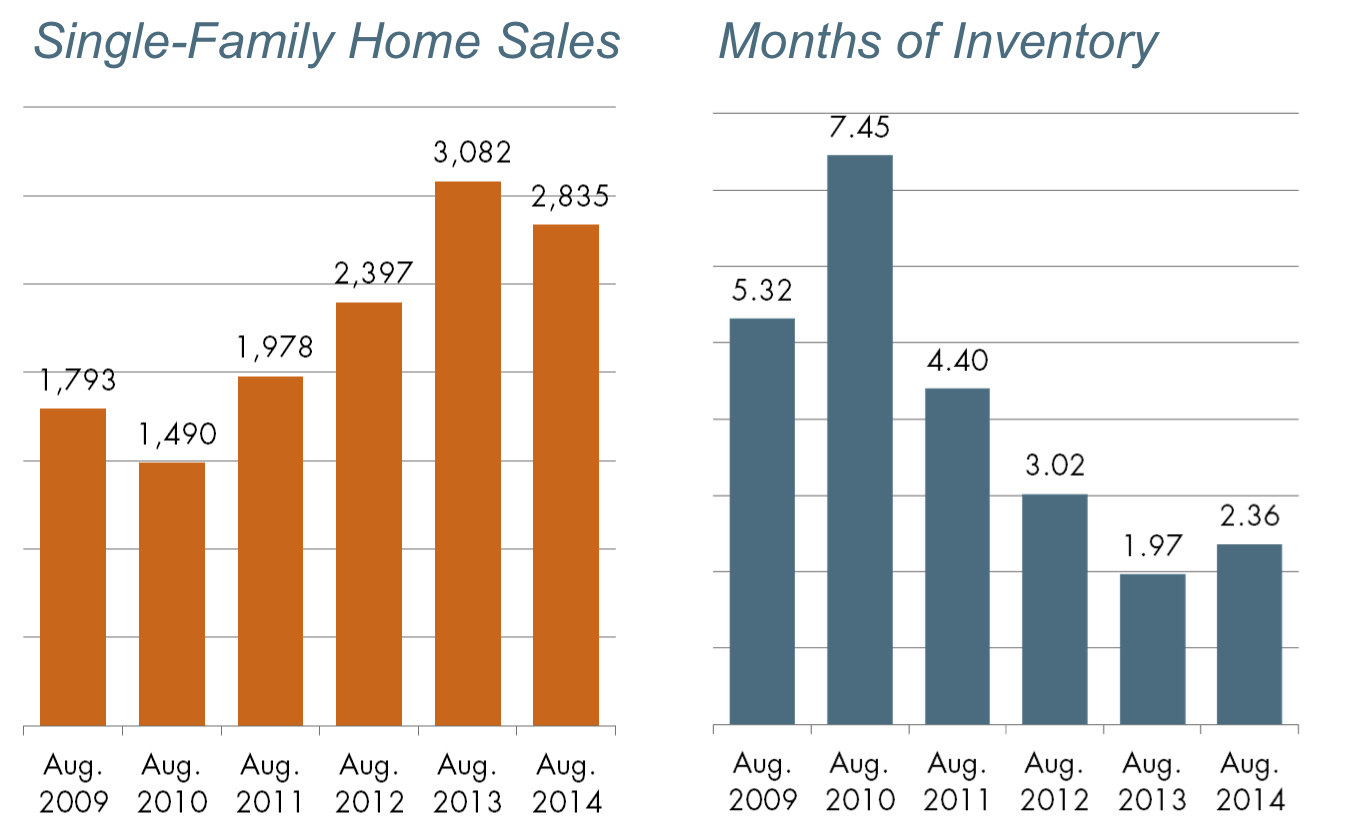

My second instinct after reading the Trulia article was to call up my friend, Ray Shapley, the smartest guy I know who’s also a realtor. Ray is owner of Shapley Realty, an Austin-based residential real estate firm, and he’s an expert when it comes to the Austin housing market. His firm provided me with some data on single-family home sales that tells the story of Austin’s housing price increases over the last several years. Enter graph #2.

Austin Metro Area Single-Family Home Sales & Months of Inventory

Realtors typically consider a 6-month inventory to be a normal, “healthy” market. With inventory levels at about 2 months in Austin, demand is much higher than the supply. I have to confess that inventory sounded like a fancy, complicated term to me…But it’s actually quite simple.

Inventory is calculated by taking the number of active home listings and dividing that by the sales. The lower the inventory, the lower the “supply” of homes on the market, relative to demand. It’s Economics 101. When you have low supply and high demand, what do you get? Rising prices. And that’s exactly what is taking place in Austin. Enter graph #3.

Austin Metro Area Single-Family Home Sales

Austin’s median home sales price has gone up by 31% from 2009 to 2014 and the average home sales price has increased by 28% during this period. And these are not estimated values. They are actual sales prices. It’s easy to see, from the numbers, the low supply and high demand. But let’s talk a bit more about what’s driving the demand.

When you have a metro area that gains more than 150 net new residents each day because of the rapid job growth and the appealing quality of life, it’s hard for the housing market to play catch-up. Which leads me to Reason #3 why there is no housing bubble in Austin.

Reason #3) Quality of Life

I just finished reading Harvard economist, Ed Glaeser’s Triumph of the City. He makes a lot of great points in the book. One of my favorites is his explanation of why some cities have high housing prices:

Most of the time, high wages and high prices go together; high housing costs are the price of accessing high-wage cities. But even correcting for prices and an individual’s skills, real wages vary from place to place. Some cities, like San Diego and Honolulu, have unusually low real incomes, while others, like Dallas, Texas and Rochester, Minnesota, have unusually high real incomes.

Should everyone in Honolulu be rushing to Dallas? Of course not. High real wages are compensating for frigid winters in Rochester and broiling summers in Dallas. Low real wages are the cost of experiencing the pleasures of San Diego and Honolulu. The market works, more or less, and when a city has really high housing prices relative to incomes, you can bet that there is something nice about the place. If an extremely attractive area had high wages and low prices, it would attract thousands of new residents who would quickly bid up the cost of living.

And that is exactly why Austin’s housing prices are much higher than the other major Texas metro areas. In fact, the latest (Nov. 2014) median single-family home sales price in the Austin market is $242,600, compared to $209,100 in Dallas, $148,700 in Fort Worth, $193,800 in Houston, and $184,100 in San Antonio.

Forbes recently calculated the top 10 most and least affordable housing markets for the middle class based on a combination of wages and home prices, which matches Glaeser’s logic perfectly. Among the top 10 most affordable cities you’ll find places like Detroit, Cleveland, and Rochester, NY. And among the top 10 least affordable cities you’ll see places like San Francisco, New York, San Diego, and Honolulu.

Bottom Line

Will Austin’s housing prices continue rising rapidly over the next several years? Probably not. The growth in home prices will eventually slow down. But when you make claims about a housing market being “the most overvalued in the country”, like Trulia and Fitch have done, you aren’t just saying that things will slow down in the future. You are saying that there is an imminent crash coming, a steep decline that is long overdue.

So, here’s my prediction: One year from now, in December 2015, housing prices in the Austin metro area will be higher than they are today. Trulia and Fitch are implicitly predicting that Austin’s housing prices will be lower one year from now than they are today. We will see who is right…

What do you think?

Great article John! It’s great to see the principals of supply and demand included in this conversation. I personally believe the Trulia article was written purely as a PR stunt.

Having lived here for 25 years I’ve seen Austin through several cycles. IMHO Austin has now crossed a threshold as a top tier tech city, and as such, I only compare Austin prices to other tech hubs, not Dallas and Houston. Austin’s prices are right in line in this comparison.

Dallas and Houston have always been spread out all over the prairie, and do not have the downtown demand that the Austin demographic desires. Austin is also much more confined in it’s growth corridors due to green spaces and restrictions.

I do not see building permits keeping up with migration nor inventory expanding, so like you I’m not quite sure how this “bubble burst” will happen anytime soon.

Cheers,

Doug-

Thank you for your insights! You bring up some good points about the high demand for downtown/urban residential in Austin vs. other large TX cities, and the additional constraints (all of the off-limits green belt land in west Austin) that drive up housing costs in the urban core. If you go far enough out in the metro area (Round Rock, Manor, Kyle) the housing prices are more in line with the rest of TX, still a bit higher, but not as much as central Austin.

Please remember that much of the demand is artificial. Two of the 4 houses in Cedar Park that I looked at this weekend were purchased on the same weekend they were listed by cash investors [who often place multiple houses under option and then choose a few on their trip out from California and let the rest lapse back onto the market.] Rest assured that these cash purchasers don’t plan to live in the houses that they’re buying, so they’ll be back on the market soon. Further, much of the frenetic demand for housing in Austin is driven by the very observable tech and education bubbles, both of which are most certainly the product of irresponsible lending. Don’t get me wrong. I love Austin and I hope I can buy a house there, but there is definitely a bubble.

Daniel-

I appreciate your comments and insights. Good point about the impacts that out-of-state investors might be having on the local market. And Austin’s economy is certainly driven by technology. We saw the impacts of that in the Dot-Com bust in the late 90s/early 2000s Among large metro areas, only Austin and Silicon Valley lost more jobs during that recession than during the Great Recession. However, the world is a different place than it was 10-15 years ago. Today, tech = business. When Austin is home to the software development centers for companies like General Motors, Union Pacific, Visa, and others, you can see how our economy is much more diversified than in the past.

I have to say that I am slightly more inclined to lean towards Daniel’s interpretation of the current housing market. No offense to you, John, (in fact I hope that you are right!) but I suffered through the last two bubbles and I just see so many similarities today. The housing market is obviously tied to the overall economy, even for Austin. The comment you made “the world is a different place than it was 10-15 years ago” is the same that was said in 1999 and in 2008. I remember Austin construction grinding to a halt (remember the abandoned half-built Intel building?) during both busts.

And two of my neighbors just sold their homes in north Austin for substantial gains. I was shocked by how quickly the homes are appreciating in my neighborhood. But, as Daniel pointed out, one of the sales was an investor from California who bought it in one day, site-unseen. I understand that there are lots of condos and homes being built, and that there is a lot of hiring going on right now but this all feels eerily familiar to me.

I’ve seen this before… I hope I’m wrong. I REALLY hope I’m wrong. The reason for my post here is not to advocate for one view or the other, but because I’m interested in the discussion. In the last bust I sold at the bottom, but it also allowed me to buy at the bottom. I’m just interested in seeing what others think about the current situation. I have no formal education or experience in this area.

Dennis-

Thank you for bringing your viewpoint to this discussion. Real estate markets are complicated animals, and I won’t pretend to have all the answers. Your right that there are several factors pointing toward prices in Austin that are getting “a bit ahead of themselves” if you will. But at the same time, Austin is really is one of the few metro areas currently making the transition from being a smaller tier/mid-size market to a major market, thanks to its thriving economy, tech ecosystem, and skilled workforce.

From an economic development perspective, Austin is leaving behind the likes of Nashville, Kansas City, Charlotte to join the big leagues of Seattle, Boston, Silicon Valley. One of my favorite data points that illustrates this transition is the growth of passenger traffic at ABIA. For the longest time, up until about 2006, ABIA and SAT had roughly the same number of monthly passengers…and in the last several years, Austin’s airport has grown its passenger traffic at a rapid pace, while San Antonio’s has remained flat. In 2014, ABIA had 5.2 million passengers, SAT had only 4 million.

In the end, we will see what happens with the housing market. It’s hard to imagine prices will continue rising rapidly for much longer. But it’s also hard to see them dropping drastically any time soon. Realistically, prices may continue growing but at a much slower pace, and maybe even decline slightly at some point in the next couple years. Thank you again for sharing your insights.

Great article. As a long time real estate investor and bull on Austin as a city, I wanted to ask if you had done any analysis regarding upcoming supply versus current demand. Often times, builders lag behind and end up oversaturating the market causing a slowdown in the overall market. Can the city issue enough permits to accommodate the demand for housing?

Thank you for your comment. I don’t have an answer to your question. Especially since I haven’t looked too carefully at the details of Austin’s housing market in several months. Other than to know that prices are still creeping upwards. And with job growth and business expansion still trending upward, it doesn’t seem like an over saturation is imminent. Not yet at least…

John your analysis was spot on for the end of 2015 and I believe it will be true for 2016 and it is now April 2016. I bought property here at the very height of the market in August 2000 and paid top dollar for a central south Austin property. (78704) I continue to hold the property and have never looked back. The only “mistake” I made was not to buy more and assume that the quality of life would not change after moving here.

Don- I appreciate your comments! Wow, I bet “top of the market” in 2000 looks dirt cheap compared to today’s real estate prices in Austin!

Hey John,

Thank you for the article.

I was trying to find demographics on the current buyers in the market. Where is this money coming from? When I ask my friends and co-workers, most of whom have M.S. or Ph.D in science and engineering, “Could you buy your current home if you were a first time home buyer in Austin?” The answer is an overwhelming NO! These are high salaried folks in the upper middle class like myself. We are all feeling gentrified given the appreciation in the market the last decade and the impact that is having on property taxes.

Add to that the difficulty I am having passing on property tax costs to my tenants, who cannot afford the rents in Austin and you get a picture of unsustainable trend not based in fundamentals.

Affordability is a metric you did not include, and since salaries are for the most part stagnant or declining in real dollar terms, affordability is under pressure. People for the most part have been able to deal with that by refinancing in a declining interest rate environment, but that cannot continue much longer, as rates are so low.

It is common for people to make statement about how the bull market will continue right before a contraction. Key to predicting Austin is to understand who the buyer is. If it is investors, they could quickly become sellers to lock in their gains.

Looking at Austin demographics (source City of Austin), most wealth is concentrated in West Austin with Senior Citizens, and much of the city is heavily weighted with rentals. I don’t see old money being replaced by an affluent younger generation, as it has been increasingly difficult.

The money to fund appreciation appears to be coming from external sources outside of our local economy, and that smells like a bubble to me, as it was for Las Vegas, and Florida in 2008.